Colorado offers some of the most stunning motorcycle rides in the nation, from the plains in the east to the Front Range and beyond. Of course, if you want to enjoy all this rugged beauty on two-wheels, you will need to carry a valid Colorado motorcycle insurance policy – it’s simply the law. Here at Motorcycle Insurance Colorado, we can help you get your bike insured – or switch to a better, more affordable policy – without leaving your computer. We help Colorado motorcyclists get the best-suited policy with the most affordable rates by allowing you to compare CO motorcycle insurance policies from various powersports insurers with whom we have partnered. Examples include:

- GEICO Motorcycle Insurance

- Nationwide Motorcycle Insurance

- Progressive Motorcycle Insurance

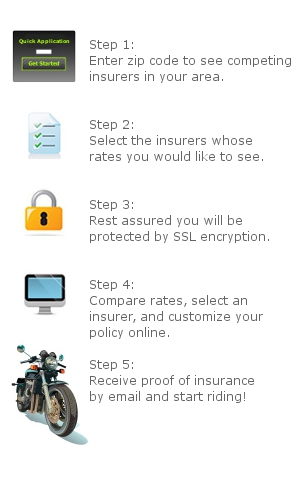

In fact, these motorcycle insurers actually compete for your business on our website, ensuring that you get the very best deal possible. Beginning your motorcycle insurance comparison is easy. Just submit your zip code.

Colorado Motorcycle Insurance Laws

As a motorcyclist in the Silver State, you don’t necessarily have to carry a highly expensive, highly extensive insurance policy. Under the law, only motorcycle liability insurance is required. However, your liability coverage must meet or exceed certain minimum thresholds for bodily injury to others and damage to third party property.

- $25,000: Liability Coverage for Personal Injury or Death to a Single Individual in an Accident

- $50,000: Liability Coverage for Personal Injury or Death to All Individuals in an Accident

- $15,000: Liability Coverage for Property Damage

Remember, these are only the minimum requirements. If you want the cheapest motorcycle insurance in Colorado, only insuring yourself up to these amounts will do the trick. However, most riders opt for more liability insurance than the state minimums. Moreover, The Insurance Research Council claims that 15% of Colorado motorists drive uninsured. You may want to consider Uninsured Motorist coverage so that you will be covered if the other driver has insufficient – or zero – liability insurance.